Upcoming events

From Banking & Payments, to Insurance, Logistics, Utilities and Transport, we bring together

the leading lights in each sector to share innovative ideas and insight.

See what’s on at MarketforceLive.

All

Americas

Europe

Online

All

Banking & Payments

Insurance

Utilities

Logistics

Banking & Payments

Conference

MoneyLIVE Payments Europe

19, 20 November 2025

Amsterdam

MoneyLIVE Payments Europe is Europe’s most senior payments event of the year, uniting 500+ leaders from banks, merchants, PSPs and the wider payments ecosystem to forge partnerships and navigate the topics at the strategic-edge of payments transformation – will you be part of the conversation?

Banking & Payments

Conference

MoneyLIVE North America

15, 16 September 2025

Chicago

With banking & payments leaders across the USA and Canada making up the lion’s share of the audience, MoneyLIVE North America is the banking conference where you can uncover transformational strategies that leave the competition behind. This is not one to be missed!

Banking & Payments

Conference

MoneyLIVE Nordic Banking

28, 29 October 2025

Copenhagen

Cut through the noise at MoneyLIVE Nordic Banking, the leading banking and payments show in the Nordic and Baltic regions. If you're passionate about open innovation, mastering AI, or real-time payments innovation, this is a must-attend event. Join 750+ industry pioneers this October to gain high impact insights, forge powerful connections, and help shape the future.

Insurance

Conference

Insurance Innovators Fraud & Claims

24 February 2026

London

Europe's leading fraud and claims event is returning to London 25th February 2025. Meet hundreds of the largest and most innovative insurance players navigating the constantly evolving fraud and claims landscape. Dig deep into new regulations and emerging trends, spearhead new strategies and connect with the people that matter. Insurance Innovators Fraud & Claims is collaboration and innovation unleashed.

Insurance

Conference

Insurance Innovators USA

11, 12 May 2026

Nashville

Welcome to the USA's greatest insurance event - where game-changing partnerships are born, and industry leaders are made. As America’s leading carrier-led event, Insurance Innovators USA offers you the golden opportunity to keep your finger firmly on the pulse of change. Join 1000+ industry leaders in iconic Nashville Music City and help us forge the future of insurance.

Insurance

Conference

Insurance Innovators Nordics

4, 5 March 2026

Copenhagen

Insurance Innovators Nordics is defining the future of insurance in the Nordic region. Now in its 10th year, we continue to push the bar, attracting hundreds of industry trailblazers from across the insurance ecosystem for this premier strategic conference. Don't miss your unique opportunity to learn, network and collaborate with the people setting the insurance agenda for 2025 and beyond. Join us 4-5 March in Copenhagen.

Insurance

Conference

Insurance Innovators Summit

4, 5 November 2025

London

The world’s most important insurance conference is coming to London 4-5 November 2025. Join 1200+ insurance big hitters and next-gen disruptors from across the globe at Insurance Innovators Summit and be part of the big conversation reshaping insurance as we know it. “Insurance Innovators sets the innovation agenda”

- Tara Foley, Chief Executive Officer, AXA Retail

Utilities

Conference

Future of Utilities Summit

10, 11 June 2026

London

The most anticipated event of the season for anyone serious about transforming the utilities landscape. Experience what can happen when the leaders from across the energy and water sectors unite to champion collaboration and bring innovation to life. Be part of the conversation and take on the greatest challenges together.

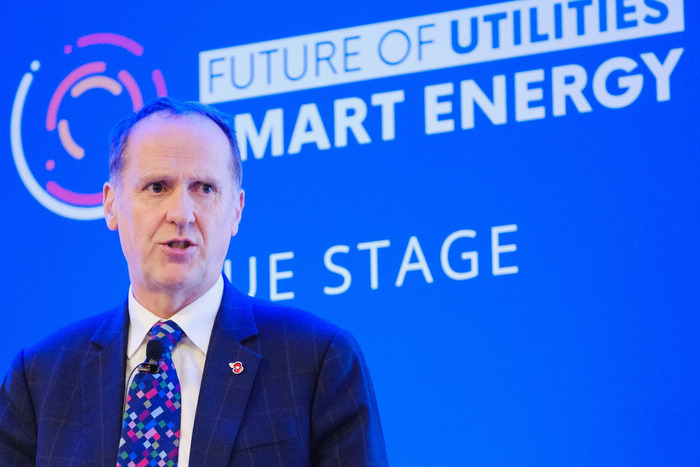

Utilities

Conference

Future of Utilities: Smart Energy

1, 2 December 2025

London

Join 900+ attendees from the energy industry’s most forward-thinking innovators paving the way to a more efficient and effective energy sector. Hear from energy Chief Executives transforming the way we distribute, manage and consume energy. Don't miss Future of Utilities: Smart Energy if you’re serious about accelerating the UK’s journey towards a modern, digital energy ecosystem.

Utilities

Conference

Future of Utilities: Energy Transition Summit

18, 19 March 2026

Amsterdam

Join 1000 attendees to ignite action, collaboration and innovation at Europe's most significant energy conference. This is the energy conference for decision-makers committed to accelerating Europe’s transition to a renewable energy ecosystem. Are you ready to advance international co-operation, dive into new policies and regulations, and discover the breakthrough technologies of tomorrow.

Logistics

Conference

Leaders in Logistics Last Mile

8, 9 October 2025

London

Leaders in Logistics: Last Mile brings together the UK & Europe’s leading carrier and postal operator professionals.Connect with a vibrant community of last mile experts from established and disruptor companies, sharing the mission to deliver faster, cheaper and more sustainably.This event is a one-stop shop to connect and build those all-important relationships in the fast-paced world of last mile e-commerce.

Logistics

Conference

Leaders in Logistics Summit

17, 18 March 2026

Brussels

Leaders in Logistics Summit sets the stage for the world’s leading carriers, postal operators, 3PLs and retail logistics professionals to come together to share their knowledge and best practices to thrive in the evolving world of parcel delivery.Learn how to harness the opportunities of international e-commerce, master the complexities of the last mile, future-proof fulfilment and warehouse operations, complete the transition towards sustainable logistics and much more.

Banking & Payments

Webinar

Satisfying Gen Z preparing for the next phase of innovation and expectation

23, July 2025

online

Satisfying Gen Z: preparing for the next phase of innovation and expectation Where will Gen Z’s expectations go next and how can banks keep pace? 23 July | 11am ET | 4pm BST | Online REGISTER NOW Gen Z is the first truly digitally-native generation – far less forgiving than millennials of sub-optimal digital experiences. […]

Banking & Payments

Webinar

AI-powered loans during a period of uncertainty

16, July 2025

Online

This webinar will examine how AI-based pricing analytics can transform consumer finance, covering everything you need to stay ahead of the competition, including: pricing and profitability optimisation, loan personalization, risk management, increasing conversions, and automating approval process.

Let's talk

Fill in the form below to get in touch. We’d love to hear from you.