Next event:

North America’s most influential banking and payments event.

MoneyLIVE sets the agenda for banking and payments innovation across the globe

We are market leaders when it comes to impactful networking, high-value insights and seamless execution. We provide the best ROI for our clients and attract leaders who truly call the shots in the global banking arena.

Join us to cut through the noise and gain unparalleled value through our industry-leading events, webinars and content.

Upcoming events

MoneyLIVE North America

MoneyLIVE Nordic Banking

MoneyLIVE Summit

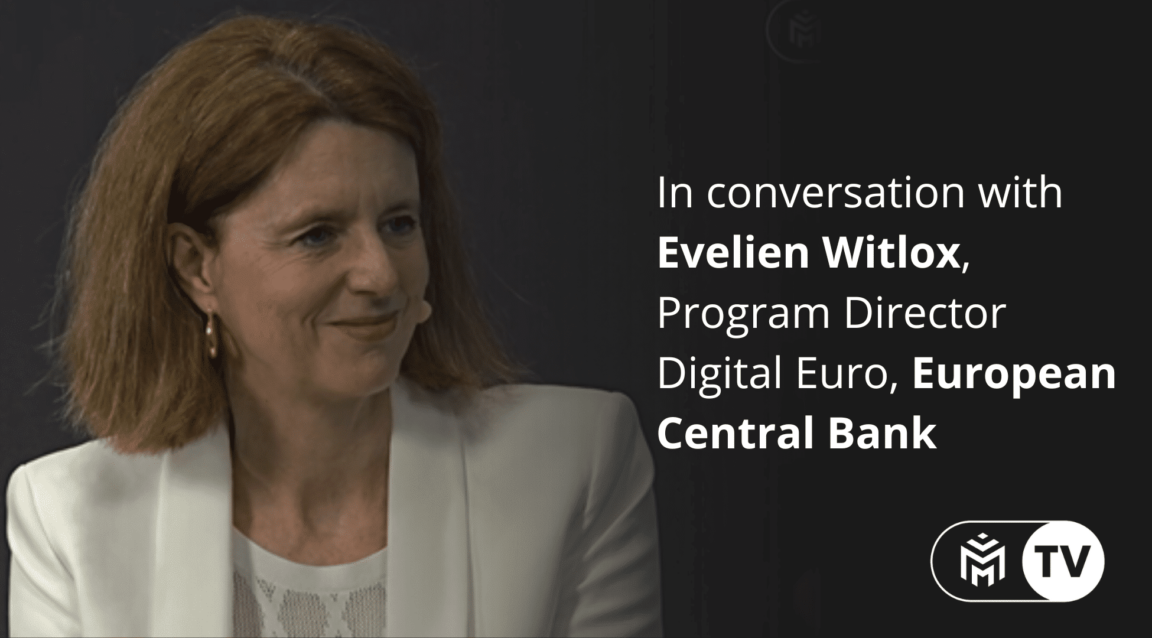

MoneyLIVE TV brings to your screen game-changing insights from banking & payments leaders and disruptors. Tune in to our live interactive panel discussions, or browse our on-demand video library to get original, groundbreaking content.

Featured videos

Our partners

We are proud to partner with leading lights across the banking & payments ecosystem.

Multi-channel demand generation

Our integrated, multi-channel campaigns connect you to the right audience through a range of engaging formats to drive interaction, generate leads and accelerate brand awareness.

Surveys & Reports

Position your brand alongside our industry-critical content to enhance credibility, and generate opted-in leads with an impactful demand generation campaign. True thought leadership comes from our winning formula of robust research, unique perspectives, timely insights, and share-worthy formats.

Meet the MoneyLIVE Advisory Board

A powerhouse of leading-industry professionals who define innovation in banking and payments. Their unparalleled expertise ensures our offerings are not just relevant, but transformative.

Get in touch

Fill in the form below to get in touch. We’d love to hear from you.