Session One

Opening remarks

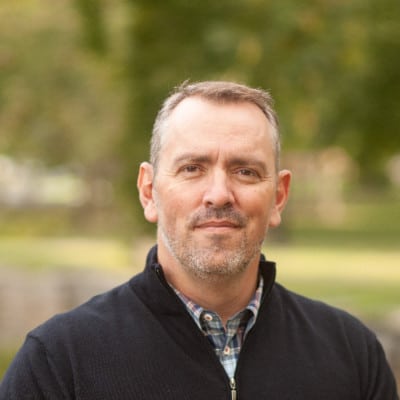

Carter Lawrence

Innovating for the future: strategies for success

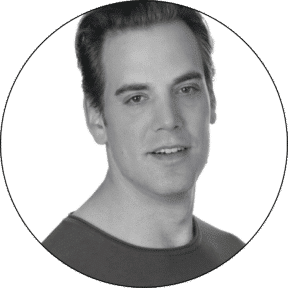

Rich Suter

Igniting innovation: shaping the future of commercial auto with the flame of AI

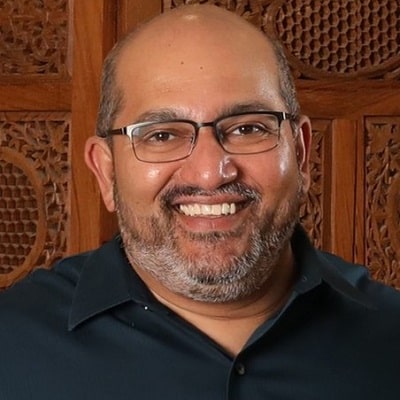

Kevin Abramson

Does regulation help or hinder innovation? US and Canadian markets – a comparative approach

Celyeste Power

Advisory session

Mark Belak

Prospects for the insurance industry | The view from a rating agency: AM Best

Jim Gillard

Strategic priorities for 2024 and beyond

- A changing risk landscape: where do the opportunities and challenges lie?

- Facing disruption head on: what strategies will be key to succeeding in the age of innovation?

- Delivering for the customer: how will the industry need to continue to evolve?

- Building a workforce fit for the future

- Navigating economic uncertainty: what are the key success factors?

- The insurtech promise: a realistic reevaluation

Donald Lacey

Kimberly Vaughn

Marcus Rohlfs

Kevin Abramson